Traditional publishers are hoping that Amazon will be distracted by selling nutritional supplements, or trade secrets to the DoD, but somehow I don't think that is going to happen.

______________________________________

DBW 2014: Amazon, Subscription and the Book Business

Publisher's Weekly, Jan 16, 2014

By Calvin Reid

Although the online retailer seemed to be the shadow topic behind most of the panels at DBW 2014, yesterday morning Amazon was front and center with presentations from Stone and Esposito—individually and in tandem—on the retailer's past and present business pursuits. Although most DBW attendees are familiar with the story, Stone took them on a trip through the recent past outlining Bezo’s aggressive pursuit of market share and Amazon’s expansions beyond books into streaming movies, toys, electronics and now, even fashion, filmmaking and TV shows through its Amazon Studio unit. It’s a story told quite well in Stone’s book: Bezo’s focus on customer satisfaction (fast delivery, great prices), razor-thin algorithm-driven profit margins and an ever-increasing enviable ability to exploit inefficiencies that Amazon seems able to identify before anyone else. It’s also the story of Bezo’s remorseless tactics and business culture—Stone noted Amazon’s notorious Gazelle Project that applied pressure on small publishers to get better discounts.

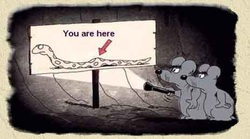

Stone said Amazon will “continue to be ruthless and self-absorbed” as it continues to disrupt new areas of the book industry and other media areas. Amazon has opened a new 44,000 square foot photo studio in Brooklyn to produce photographs for its apparel/fasion business. The retailer has a fast growing grocery business and both Stone and Esposito pointed to Amazon plans to launch its own TV set box. But these new ventures are unlikely to provide much solace to the book industry or distract Amazon from the book trade, both presenters said, because Amazon will continue its relentless pursuit of market share in the book industry. “If e-book sales flatten, they will look for new ways to boost them,” Stone said, “packaging books together,”—he cited Amazon’s Matchbook Project which bundles e-books with print—and there’s even the possibility Amazon will experiment with physical spaces, setting up its own showrooms to display books and other kinds of merchandise.

In other words, look for more of Amazon’s characteristic efforts to enter businesses and “build moats”—low prices and customer-stroking service built on tiny margins—around them that will continually feed its growth and discourage other companies from entering the same business category. Esposito (with a grant from Carnegie Mellon) has organized a university press research project to look at academic press book marketing.

Esposito outlined efforts by Amazon to squeeze ever-tougher terms from cash-strapped nonprofit university presses as well as its efforts to displace distributors like B&T and Ingram with cheaper prices and faster service. He even outlined a “supply chain paradox,” a case study of how Amazon orders titles from third-party distributors, gets them to ship books to libraries overnight packaged in an Amazon box—although paradoxically the same distributor would take longer to ship the title if the sale came to them directly. Esposito said Amazon has about a 10% share of the library market and is taking a growing share of overseas sales of academic titles, disrupting the roles of conventional distributors. “Amazon is thinking 3-5 years ahead and positioning themselves accordingly,” he said.

RSS Feed

RSS Feed